Accountants are one of the most in-demand professions in Canada today. Due to their official designation, Chartered Professional Accountants, or CPAs, have a distinct advantage over non-designated financial professionals in the industry. Unemployment rates for qualified accountants in Canada are far below average, which means that accounting work is in high demand

Continue reading to learn more about what accountants do and why this is a worthwhile career to pursue in Canada.

What Exactly Do Accountants Do?

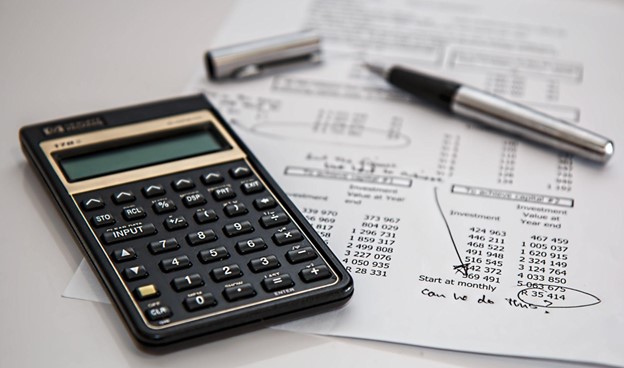

An accountant is the backbone of a company’s finances; they create and review financial records and ensure that all taxes are paid on time. Although tax season is a busy time of year, an accountant is active all year. Accountants provide insight into a business’s financial operations, ensuring that they run smoothly. Personal accountants do the same thing for people to improve their financial situation.

How Can I Become an Accountant?

In order to become a CPA in Canada, there are a few steps you’ll need to follow. The most common route is to get a bachelor’s degree in a relevant field from a recognized Canadian university, after which you’ll need to enroll in the CPA Professional Education Program or PEP for short.

What Is the PEP?

CPA PEP is a two-year, part-time accounting curriculum designed for accounting professionals with full-time jobs. This program consists of six modules:

- Two core modules focused on the six technical abilities: financial reporting, management accounting, strategy and governance, finance and taxation, and audit and assurance

- Two electives from the assurance, performance management, or tax and finance categories

- One integrative capstone course in which you will hone your business and leadership skills

- One course for preparing for the capstone exam

Each module is followed by an exam, and if you want to work in tax or public accounting, you’ll need to take additional exams. As a CPA candidate, you must pass the previous module examination before proceeding to the next.

What If I Don’t Have an Undergraduate Degree?

Not to worry if you don’t have an undergraduate degree—you may still be qualified to take the PEP. However, you must show that you have eight years or more of relevant work experience in the CPA technical competency areas. Additionally, you have to finish the prerequisite classes for the CPA PEP, provide three letters of recommendation, and compose a personal statement.

Before certifying you as a CPA, CPA Canada must review your credentials if you are not a Canadian or if you earned your accounting school elsewhere.

Education alone does not a CPA make. A CPA designation is really a mark of the hard work you’ve put into learning about the field and your willingness to study hard to pass your exams. Finding the suitable courses to take to help prepare you for your eventual CPA work is a crucial part of the process.

When you’re ready to take the plunge into accounting courses, look no further than Computek College. At Computek, we offer an Accounting, Payroll, and Tax diploma program to help you get started on your accounting journey. Check out our website today to learn more about our courses!